getspectrum.ru Prices

Prices

Lithium Corporation Of America Stock

As a result, we reduce our Lithium Americas fair value estimate to $10 (CAD 14) from $12 (CAD 16). Our no-moat rating is unchanged. Lithium Americas Corp (LAC) NPV ; Open · CAD ; Trade high · CAD ; Year high · CAD ; Previous close · CAD ; Trade low · CAD. Key Stats · Market CapM · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta- · YTD % Change The current price of LAC is CAD — it has increased by % in the past 24 hours. Watch LITHIUM AMERICAS CORP stock price performance more closely on the. getspectrum.ru · r/LithiumAmerica - Lithium Americas Stock: Buy The. Lithium Americas Corp. (NYSE:LAC) institutional ownership structure shows current positions in the company by institutions and funds, as well as latest changes. Lithium Americas Corp. ; 12 Month Change. N/A ; Day Range - ; 52 Wk Range - ; Volume, M ; Market Value, $M. Lithium Americas is focused on advancing Thacker Pass to production. The company trades on both the Toronto Stock Exchange (TSX: LAC) and the New York Stock. OPEN. ; PREV. CLOSE. ; VOLUME. 2,, ; MARKET CAP. M ; DAY RANGE. – As a result, we reduce our Lithium Americas fair value estimate to $10 (CAD 14) from $12 (CAD 16). Our no-moat rating is unchanged. Lithium Americas Corp (LAC) NPV ; Open · CAD ; Trade high · CAD ; Year high · CAD ; Previous close · CAD ; Trade low · CAD. Key Stats · Market CapM · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta- · YTD % Change The current price of LAC is CAD — it has increased by % in the past 24 hours. Watch LITHIUM AMERICAS CORP stock price performance more closely on the. getspectrum.ru · r/LithiumAmerica - Lithium Americas Stock: Buy The. Lithium Americas Corp. (NYSE:LAC) institutional ownership structure shows current positions in the company by institutions and funds, as well as latest changes. Lithium Americas Corp. ; 12 Month Change. N/A ; Day Range - ; 52 Wk Range - ; Volume, M ; Market Value, $M. Lithium Americas is focused on advancing Thacker Pass to production. The company trades on both the Toronto Stock Exchange (TSX: LAC) and the New York Stock. OPEN. ; PREV. CLOSE. ; VOLUME. 2,, ; MARKET CAP. M ; DAY RANGE. –

How to buy LAC stock on Public · Sign up for a brokerage account on Public · Add funds to your Public account · Choose how much you'd like to invest in LAC. The Lithium Americas Corp stock price today is What Is the Stock Symbol for Lithium Americas Corp? The stock ticker symbol for Lithium Americas Corp is. Analyst Forecast. According to 9 analysts, the average rating for LAC stock is "Buy." The month stock price forecast is $, which is an increase of Lithium Americas Corp. ; Volume, K ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), N/A. NYSE: LAC ; Price. $ ; Volume. 3,, ; Change. + ; % Change. +% ; Today's Open. $ This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since it has more than doubled. Lithium Americas (NYSE: LAC) · Lithium Americas Return vs. S&P · Lithium Americas Company Info · News & Analysis · Financial Health · Valuation · Related Stocks · NYSE. Get the latest Lithium Americas Corp (LAC) real-time quote, historical performance, charts, and other financial information to help you make more informed. Lithium Americas Corp (NewCo) ; Mar, Downgrade, Scotiabank, Sector Outperform → Sector Perform, $15 → $7 ; Dec, Initiated, JP Morgan, Neutral, $7. American Lithium is a Company with Strong Progress on the Ground and at the Corporate Level. Corporate Deck. Discover real-time Lithium Americas Corp. Common Shares (LAC) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Find the latest Lithium Americas Corp. (getspectrum.ru) stock quote, history, news and other vital information to help you with your stock trading and investing. AMLI | Complete American Lithium Corp. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. On Wednesday, Lithium Americas Corp (LAC:NYQ) closed at , % above the 52 week low of set on Aug 05, week range. Today. Aug 05 Lithium Americas Corp. · AFTER HOURS PM EDT 08/22/24 · % · AFTER HOURS Vol 42, M With a near-term focus on these mining-friendly jurisdictions, the company has the advantage of both geographic and geological diversity in developing. Lithium Americas Corp Equity-NMS: LAC ; 52W low: $ ; 52W high: $ ; 1Y: % ; 5Y: % ; Shares O/S: M. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since it has more than doubled. Lithium Americas Corp. (LAC) has a Smart Score of 1 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom. Real-time Price Updates for Lithium Americas Corp (LAC-T), along with buy or sell indicators, analysis, charts, historical performance, news and more.

Balance Transfer Without Card

0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that. Get more flexibility with a credit card balance transfer · Pay off credit cards with higher interest rates · Consolidate balances to make managing payments easier. Text: Look for a card without balance transfer fees. Ask yourself: what's Select the card you'd like to transfer a balance to, and select Balance Transfer. Select your credit card. · Online banking: Choose Account services, then select Balance transfer from the "Payments" section. · Review the offers shown; when you. Can I use a Visa balance transfer for items other than credit card or loan debt? Yes. In addition to paying off existing debt, you can use a Visa balance. It's essentially transferring your credit card debt to another card with zero percent (or low) rates that allow you to whittle down the debt without paying. 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that. 10 partner offers ; Blue Cash Preferred Card from American Express · 0% on Purchases and Balance Transfers for 12 months ; Citi Diamond Preferred Card · 0% for 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that. Get more flexibility with a credit card balance transfer · Pay off credit cards with higher interest rates · Consolidate balances to make managing payments easier. Text: Look for a card without balance transfer fees. Ask yourself: what's Select the card you'd like to transfer a balance to, and select Balance Transfer. Select your credit card. · Online banking: Choose Account services, then select Balance transfer from the "Payments" section. · Review the offers shown; when you. Can I use a Visa balance transfer for items other than credit card or loan debt? Yes. In addition to paying off existing debt, you can use a Visa balance. It's essentially transferring your credit card debt to another card with zero percent (or low) rates that allow you to whittle down the debt without paying. 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that. 10 partner offers ; Blue Cash Preferred Card from American Express · 0% on Purchases and Balance Transfers for 12 months ; Citi Diamond Preferred Card · 0% for

Many balance transfer cards offer 0% interest on transfers but finance new purchases at a normal rate. This means making new purchases on your card will not. Cards like Citizens Clear Value® Mastercard® could be a top consideration if you want to transfer a balance. For instance, it offers an month 0% APR, which. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. You might also lower your overall. MEMBER WITHOUT CARD · Apply for a SECU credit card and enter your balance transfer details · Once approved, it will take weeks for your balance to transfer. Discover U.S. News' picks for the best balance transfer cards. Find the best 0% APR and low interest card offers to save money and pay off your debt. Many lenders allow you to see your offers and request the balance transfer on their mobile app or online banking. Look for a credit card intended for balance. A Skyla credit card has 0% APR* for the first 12 months, meaning you can work on paying down your debt without racking up additional interest. Transfer My. The Citi® Diamond Preferred® Card comes with a 0% intro APR on balance transfers for 21 months from the date of your first transfer for balance transfers. Alternatively, the transfer can be done online or by phone. In those cases, you contact the credit card company to which you are transferring the balance. Give. Low Rate Credit Card Benefits · New Cardholders: 0% for 12 months introductory APR on purchases within the first year and balance transfers completed within the. You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The. If researched thoroughly, zero percent or low-interest credit card balance transfer can be a good way to combine multiple, higher-interest credit card balances. A balance transfer card may offer perks—like 0% introductory APR or no annual fee—that could help you save big. Some cards even let you earn rewards in the. Wells Fargo has a zero percent interest card for 21 months but it comes with a 3 percent fee. This card is the best option since you will have. If you transfer a balance from a high-interest credit card to a Discover Card with an introductory 0% APR balance transfer offer, you can use the money you save. Because it typically has a lower or 0% interest rate for a fixed period, a balance transfer card could help you get on top of your credit card debt and reduce. If you recently received notice of your credit limit and the rest of the account-opening disclosures, you may be able to cancel the balance transfer. Balance transfer fee of either $5 or 5% of the amount of each credit card balance transfer, whichever is greater. Balance Transfers must be completed within 4. Cons · Often requires high credit scores. You likely won't be eligible for the most competitive interest rates on your balance transfer credit card without good. Transfer your balance to an Altra Visa Credit Card and enjoy a fixed balance transfer rate as low as % APR and no balance transfer fees.

Best Indexed Universal Life Policies

Indexed universal life insurance policies provide greater upside potential, flexibility, and tax-free gains. · This type of life insurance offers permanent. However, the policy ties the rest to the performance of a set grouping of stocks like the S&P or NASDAQ. This makes IUL value growth riskier and also. Best universal life insurance companies ; Nationwide, /1,, A+ ; Northwestern Mutual, /1,, A++ ; Prudential, /1,, A+ ; State Farm, /1,, A++. Indexed universal life insurance The growth of the cash value in this type of policy is linked, in part, to the performance of one or more stock market. Securian Financial's BGA2 IUL. It has an uncapped 2 Year S&P index, uncapped 3 Year PRISM index, and 1 Year 10% cap S&P with a 2% floor rate. Investopedia explains that the allure of IUL is in “the potential for healthy gains in the cash value—gains that can be significantly higher than those possible. Below we reveal the top 5 IUL policies of and take a deep dive into the criteria deciding the best IUL companies for cash accumulation. Life insurance can offer protection and flexibility to your financial strategy. Allianz offers term insurance and indexed universal life insurance. The Best IUL Companies of & Why · Allianz – Best IUL Company with Diverse Indexed Crediting Strategies · Columbus Life – IUL Company with Best Treatment. Indexed universal life insurance policies provide greater upside potential, flexibility, and tax-free gains. · This type of life insurance offers permanent. However, the policy ties the rest to the performance of a set grouping of stocks like the S&P or NASDAQ. This makes IUL value growth riskier and also. Best universal life insurance companies ; Nationwide, /1,, A+ ; Northwestern Mutual, /1,, A++ ; Prudential, /1,, A+ ; State Farm, /1,, A++. Indexed universal life insurance The growth of the cash value in this type of policy is linked, in part, to the performance of one or more stock market. Securian Financial's BGA2 IUL. It has an uncapped 2 Year S&P index, uncapped 3 Year PRISM index, and 1 Year 10% cap S&P with a 2% floor rate. Investopedia explains that the allure of IUL is in “the potential for healthy gains in the cash value—gains that can be significantly higher than those possible. Below we reveal the top 5 IUL policies of and take a deep dive into the criteria deciding the best IUL companies for cash accumulation. Life insurance can offer protection and flexibility to your financial strategy. Allianz offers term insurance and indexed universal life insurance. The Best IUL Companies of & Why · Allianz – Best IUL Company with Diverse Indexed Crediting Strategies · Columbus Life – IUL Company with Best Treatment.

If taking care of your loved ones and building your best financial future top your list, our indexed universal life insurance (IUL) can help you work toward. Indexed universal life (IUL) is permanent life insurance that offers financial protection, growth opportunities linked to market index performance and. A 1% minimum guaranteed interest rate. Growth tied to a current credited interest rate. Indexed Universal Life. Best for. Members seeking flexible premiums. When you buy permanent* life insurance, you have a few options. Two popular choices are whole life insurance and indexed universal life (IUL). Long-term life insurance providing death benefit protection, competitive guarantees, and the flexibility to help meet a lifetime of needs. Best Overall: Northwestern Mutual; Best Variable Universal Life Insurance: Nationwide; Best Indexed Universal Life Insurance: Mutual of Omaha; Best Reputation. whole life) to get a better idea of whether it meets your needs. Nationwide® Indexed Universal Life Accumulator II offers permanent life insurance. Indexed universal life (IUL) insurance is permanent, which means it lasts your entire life and builds cash value. An IUL policy allows for some cash value. Two popular permanent insurance policies available are Whole Life policies, which yield a guaranteed fixed return, and Indexed Universal Life (IUL) policies. Indexed universal life insurance is a type of permanent plan with a savings component. Unlike some traditional life insurance plans. Indexed universal life insurance is a type of permanent life insurance, which means it has a cash value component in addition to a death benefit. Indexed universal life (or IUL) is a type of universal life that may appeal to those who want premium flexibility with the potential for greater growth (than. Best Universal Life Insurance Companies ; Pacific Life · · $ ; Northwestern Mutual · · N/A ; Guardian Life · · $ ; Protective · · $ ; Lincoln. Universal life insurance gives you lifelong protection and cash value you can use for anything, anytime, plus the flexibility to adjust your policy along the. How does IUL work? When you make a payment to your Indexed Universal Life policy, a portion of that payment goes toward the life insurance benefit that. Prudential Insurance Company and Voya Financial are some of the biggest providers of indexed universal life insurance. Voya is considered a top-tier provider. Indexed universal life insurance offers cash value growth potential that is tied to the movement of an underlying index but does not participate in the market. Is Indexed Universal Life Insurance (IUL) Good or Bad? · Level Term · Renewable Term Insurance · Premiums · Death Benefit · Fees · Cash Account · Flexible Premiums. Indexed universal life (IUL) offers premium and coverage flexibility with the potential for more cash value growth because it's linked to the performance of. Index universal life (IUL) insurance can be a great way to protect your loved ones and their financial well-being while building potential tax-advantaged cash.

Competitive Intelligence In Business

Competitive intelligence (CI) research is the process of gathering and analyzing information about a competitor's products, services, strategies, strengths. Klue is a market and competitive research platform built to automate, streamline, and make it easier to distribute intelligence insights across an organization. Competitive intelligence is a sub-type of business intelligence. It still involves a company collecting and analyzing mass quantities of data, but most of this. Benefits Of Competitive Intelligence · 1. Respond faster to new market threats · 2. Capitalise on new market opportunities · 3. Become the best-informed business. Competitive intelligence is the process of collecting and analyzing information about your competition to gain an advantage in the industry. With a curriculum rooted in the functional areas of business and data analytics, Business and Competitive Intelligence graduates are prepared to discover future. What is Competitive Intelligence? CI is the collection and analysis of information to anticipate competitive activity and see past market disruptions. Competitive intelligence (CI) is the process of gathering, analyzing, and interpreting information about a company's competitors, industry trends, and market. Competitive intelligence is the collection and analysis of information that helps you anticipate competitive business activity. This may include the development. Competitive intelligence (CI) research is the process of gathering and analyzing information about a competitor's products, services, strategies, strengths. Klue is a market and competitive research platform built to automate, streamline, and make it easier to distribute intelligence insights across an organization. Competitive intelligence is a sub-type of business intelligence. It still involves a company collecting and analyzing mass quantities of data, but most of this. Benefits Of Competitive Intelligence · 1. Respond faster to new market threats · 2. Capitalise on new market opportunities · 3. Become the best-informed business. Competitive intelligence is the process of collecting and analyzing information about your competition to gain an advantage in the industry. With a curriculum rooted in the functional areas of business and data analytics, Business and Competitive Intelligence graduates are prepared to discover future. What is Competitive Intelligence? CI is the collection and analysis of information to anticipate competitive activity and see past market disruptions. Competitive intelligence (CI) is the process of gathering, analyzing, and interpreting information about a company's competitors, industry trends, and market. Competitive intelligence is the collection and analysis of information that helps you anticipate competitive business activity. This may include the development.

Competitive intelligence is the collection and analysis, by a company, of openly-available data on their competitors, which is then used to develop business. Competitive Intelligence is a unique solution that not only helps you business. Why use Competitive Intelligence: Compare your average star rating. Top Market & Competitive Intelligence Research Companies · Featured Experts in Top Market & Competitive Intelligence Research Companies · NewtonX · Juniper. Competitive Intelligence is an essential component of developing business strategy. It provides you with valuable insights into the competitors, marketplace. Competitive intelligence is the practice of gathering and analyzing information relating to an organization's competitors and using these insights to create a. Competitive intelligence is a sub-type of business intelligence. It still involves a company collecting and analyzing mass quantities of data, but most of this. Several factors beyond competitors and industry can have major impacts are your business. Defining your company's use case for competitive intelligence will. Competitive intelligence (CI) is the process of systematically gathering, monitoring, analyzing, and disseminating external information of strategic value to. Competitive intelligence involves gathering and analyzing information about a company's industry, competitors, and market trends to inform strategic decision-. Competitive intelligence is about knowing how good your business is versus competition. Acknowledging the presence of your competitors (and their strengths). A competitive intelligence analysis is the process of gathering, analyzing, and disseminating information about competitors, markets, and industry trends in. Key Takeaways · Competitive intelligence is the outward-focused analysis of a business's competitors to identify advantages and potential strategies. · In. Competitive Intelligence (CI) is a critical aspect of product management and operations, providing a systematic and ethical program for gathering, analyzing. In effect, competitor intelligence is a specific type of market intelligence. As a result, a good quality provider of market intelligence should offer. Companies can use competitive intelligence to develop marketing campaigns that highlight their unique value proposition and target customers who are. Competitive Intelligence is a discipline that enables organizations to reduce strategic risk and increase revenue opportunities by having a deep understanding. Business intelligence (BI) and competitive intelligence (CI). They may seem similar, but they perform different functions and analyze two disparate sets of. Competitive Intelligence Competitive intelligence essentially means understanding and learning what's happening in the world outside your business so you can. Competitive Intelligence involves collecting and analyzing information about your key competitors. market position and gain a competitive edge. Before you. Competitive intelligence helps businesses develop effective marketing strategies, optimize product development, anticipate market changes, and stay ahead in the.

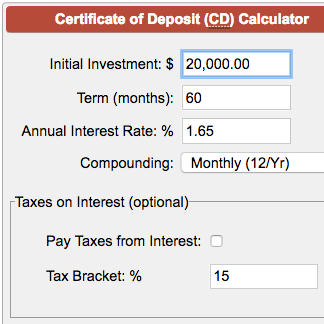

How To Calculate Interest On A Cd

Calculate to find out how much interest can be earned on Certificate of Deposits (CDs). By using this resource, you can learn about your annual percentage. Free calculator to find the total interest, end balance, and the growth chart of a Certificate of Deposit with the option to consider income tax. How to use our CD calculator · Deposit amount. This is the amount of money you'll put in a CD. · APY. The interest rate that CDs offer can vary wildly, largely. The annual percentage yield (APY) of a certificate of deposit (CD) is the amount of interest that a CD pays in a year. · If a CD pays 1% APY and you deposit $ How to use our CD calculator · Deposit amount. This is the amount of money you'll put in a CD. · APY. The interest rate that CDs offer can vary wildly, largely. A CD ladder is your best option for a savings portfolio that will deliver both interest income and available cash. This calculator will help you build a CD. Use the United Community Bank Certificates calculator to compare Certificates of Deposits terms, interest rates and yields. The interest rate is the percentage of the principal amount that the financial institution will pay you for leaving your money in a CD until it matures. What. A certificate of deposit (or CD) is a savings instrument offered by a bank or credit union that has a fixed date of maturity and a fixed interest rate. Calculate to find out how much interest can be earned on Certificate of Deposits (CDs). By using this resource, you can learn about your annual percentage. Free calculator to find the total interest, end balance, and the growth chart of a Certificate of Deposit with the option to consider income tax. How to use our CD calculator · Deposit amount. This is the amount of money you'll put in a CD. · APY. The interest rate that CDs offer can vary wildly, largely. The annual percentage yield (APY) of a certificate of deposit (CD) is the amount of interest that a CD pays in a year. · If a CD pays 1% APY and you deposit $ How to use our CD calculator · Deposit amount. This is the amount of money you'll put in a CD. · APY. The interest rate that CDs offer can vary wildly, largely. A CD ladder is your best option for a savings portfolio that will deliver both interest income and available cash. This calculator will help you build a CD. Use the United Community Bank Certificates calculator to compare Certificates of Deposits terms, interest rates and yields. The interest rate is the percentage of the principal amount that the financial institution will pay you for leaving your money in a CD until it matures. What. A certificate of deposit (or CD) is a savings instrument offered by a bank or credit union that has a fixed date of maturity and a fixed interest rate.

This guide provides step-by-step instructions on setting up your spreadsheet for accurate CD interest calculation. Compute the periodic interest rate offered by the CD by dividing the annual rate by the compounding periods per year. For example, if your CD compounds interest. Interest earned on your CD's accumulated interest. This calculator allows you to choose the frequency that your CD's interest income is added to your account. Use this calculator to find out how much interest you can earn on a Certificate of Deposit (CD). Just enter a few pieces of information and we will calculate. Technically, you can calculate APY with this formula: (1+r/n)n – 1, but it's easy to use an APY calculator to quickly figure out your APY. Additionally, when. Specifically, APY represents the amount of interest earned, including compound interest, over the period of an entire year. How to Use a Certificate of Deposit. Use this calculator to find out how much interest you can earn on a Certificate of Deposit (CD). Just enter a few pieces of information and we will calculate. It is the interest the bank agrees to pay you for keeping your funds in a CD over the designated period. Rates on CDs are typically higher than those on regular. Use this Certificate of Deposit Calculator to help determine the potential interest growth and tax liability on your Certificate of Deposit CDs · Open a CD. The tool uses this amount to calculate the number of CDs in the ladder. The interest earned on your CDs is added to your CD balance at regular intervals. A CD is a savings product that pays interest on a deposit, usually at a These calculations do not reflect the terms available for any Regions CD. Formula for Calculating CD Interest · A is the total that your CD will be worth at the end of the term, including the amount you put in. · P is the principal, or. Starting with $10, at % interest results in $10, x = $ interest for a final sum at the end of year one of $10, In year two the calculation. To the extent the calculator provides investment-related calculations, actual returns and principals values will vary. We're happy to discuss much more than. Are you thinking of buying a CD? Use this free calculator to find out how much interest you'll earn. For a given deposit and interest rate we'll calculate your. Calculated values assume that principal and interest remain on deposit and are rounded to the nearest dollar. All APYs are subject to change. Our rate effective. Just enter a few pieces of information and we will calculate your annual percentage yield (APY) and ending balance. The interest earned on your CD is added to. Use this calculator to find out how much interest you can earn on a certificate of deposit (CD). Just enter a few pieces of information and we will calculate. How is interest calculated on my CD account? Union Savings Bank has fast answers to the most common inquiries. Bank FAQ's on varied topics can be found. Most CDs require a minimum deposit amount and may offer rates contingent on the size of the deposit. The interest you earn on your deposit depends on the.

Dcm Services Collection Agency

The Fair Debt Collection Practices Act (FDCPA) prohibits a debt collector from misrepresenting the legal status of a debt, which includes falsely implying that. CREDIT SERVICE COMPANY. INC DBA COLORADO. CHECK RECOVERY DBA. THE. ACCOUNTS DCM SERVICES LLC. PENN AVE S STE A RICHFIELD, MN 80 GARDEN CTR. DCM's primary purpose is to collect an overdue debt from you, even though it is not directly yours. DCM is a legitimate, average-sized debt collection agency. DCM Services' Post · More Relevant Posts · CFPB Report Highlighting Consumer Protection Issues in Medical Debt Collection | Consumer Financial. It's a debt collector for amex. DCM services. img. logo. Estate Lawyer: Jessica B. Oh yes I know them well. Collection Agencies. Make your agency more effective by never missing Learn More About DCM Services Estate Solutions! See Probate Finder OnDemand. DCM Services is a third-party collection agency that specializes in collecting overdue debts from the estates of deceased debtors. DCM Services is a debt collection agency. If you are seeing them on your credit report, it likely means they have purchased your debt from a creditor and are . DCM Services, LLC is a collection agency located in Minneapolis, MN. They have been in business since Address: Penn Ave S, Minneapolis, MN The Fair Debt Collection Practices Act (FDCPA) prohibits a debt collector from misrepresenting the legal status of a debt, which includes falsely implying that. CREDIT SERVICE COMPANY. INC DBA COLORADO. CHECK RECOVERY DBA. THE. ACCOUNTS DCM SERVICES LLC. PENN AVE S STE A RICHFIELD, MN 80 GARDEN CTR. DCM's primary purpose is to collect an overdue debt from you, even though it is not directly yours. DCM is a legitimate, average-sized debt collection agency. DCM Services' Post · More Relevant Posts · CFPB Report Highlighting Consumer Protection Issues in Medical Debt Collection | Consumer Financial. It's a debt collector for amex. DCM services. img. logo. Estate Lawyer: Jessica B. Oh yes I know them well. Collection Agencies. Make your agency more effective by never missing Learn More About DCM Services Estate Solutions! See Probate Finder OnDemand. DCM Services is a third-party collection agency that specializes in collecting overdue debts from the estates of deceased debtors. DCM Services is a debt collection agency. If you are seeing them on your credit report, it likely means they have purchased your debt from a creditor and are . DCM Services, LLC is a collection agency located in Minneapolis, MN. They have been in business since Address: Penn Ave S, Minneapolis, MN

Credit Bureau Collection Services, Inc. Credit Control Services, Inc DCM Services, LLC; Debt Recovery Solutions, LLC; Debtsy, Inc. Delta Management. Credit Reports. Looking for a credit report on DCM Services LLC? Our Business Information Report Snapshot is a collection of business credit scores and. Find Debt Collection Companies in Alphabetic Order · DCM Services. DMG Consulting · Direct Recovery Services. Diversified Collection Services (DCS) · Enhanced. MA Debt Collector. , , DCM Services, LLC, Penn Avenue South Suite A, Richfield, MN, USA, , Martha Hanson, , licenses@. DCM Services, LLC (DCMS) is a collection agency. DCMS works with organizations across industries, including financial services, healthcare, telecommunications. Who can a debt collector contact about a deceased person's debt? The law protects people — including family members — from debt collectors who use abusive. DCM Services Collections (DCMS), a player in the debt collection arena, is bound by the provisions of the FDCPA. It is imperative for consumers to be aware that. I just found a letter mailed to my father's address from DCM Services which I gather is a debt collection agency but I know for a fact my father had no. The IRS assigns certain overdue federal tax debts to private debt collection agencies. Review the list of agencies and what debts the IRS assigns and does. Through the Cross-Servicing program, we provide delinquent debt collection services to federal agencies. We work with debtors based on their ability to pay. We. The collection agency has no phone number on the paperwork and no email address. It's not like they can hurt the credit score of a dead person. As the only collection agency in the US focused exclusively on deceased accounts, DCM Services' process has become an industry standard for all creditors. DCM Services LLC is a debt collection agency based in Minneapolis, MN. They specialize in providing innovative solutions and technology-driven services to. DCM Services. In addition to the webinar content, over. 50 questions were 4) Outsource to a specialty collection agency/law firm. Do nothing. It is. Founded in and headquartered in Minneapolis, Minnesota, DCM Services is a third-party collection agency with a primary focus on estate recover ies. Here's what another consumer said in their complaint to the Consumer Financial Protection Bureau. After receiving this complaint, the debt collection agency. If there's a balance due, you'll receive a billing statement in the mail or in your LiveWell account. · If you set up a payment plan, any new service charges. Credit Reports. Looking for a credit report on DCM Services LLC? Our Business Information Report Snapshot is a collection of business credit scores and. Founded in and headquartered in Minneapolis, Minnesota, DCM Services is a third-party collection agency with a primary focus on estate recover ies. Before joining the debt collection agency world in , Bauer spent 15 years as a partner in the Minneapolis law firm of Messerli & Kramer PA. Posts.

2 3 4 5 6